Vicissitudes of the Markets

This is the last trading day of the year, 2016.

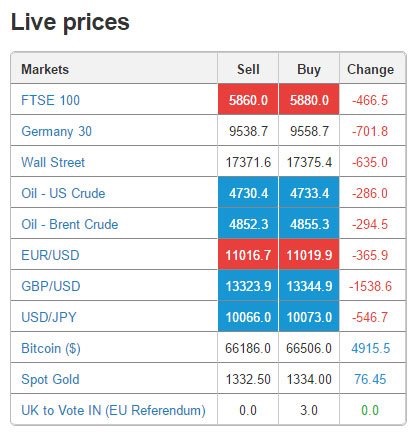

It’s been quite a rollercoaster year in the financial markets with certain themes standing out and holding significant weight.

#Brexit was a momentous occasion in the United Kingdom as they voted to “leave” the European Union. Inadvertently, the Sterling Pound fell 10% on the aftermath of the vote.

The Japanese Yen, which is a perfect carry trade currency, was surging throughout the year from 120 level to 100 level, however it snapped the trend due to a dollar rally. #TrumpRally

Long dated bonds, especially 10 year bonds in Japan and Germany registered negative yields. UK Gilts and US Treasuries also registered very low yields though they snapped the trend ultimately.

I wonder how asset managers for the pension industry are navigating the asset/ liability matching conundrum as they are overweight bonds, especially long dated bonds unlike some in general insurance who are overweight in short term dated bonds

A long political fight in the US ensued and the final result pitied Hillary Clinton against the eventual champion, Donald Trump.

In Africa, Nigeria economy fell into a recession and the situation was punctuated with capital controls on the Nigerian Naira. In as much as the Naira was allowed to float freely, from 199.00, it found resistance at 315 and many view this as still controlled and does not reflect the true market price.

South Africa’s Rand flash crash early in January during Asian trading session was an outlier where it fell about 9% in seconds. (The Pound also had a 6% flash crash during the quiet Asian trading session, marked with low volumes.)

The NSE touched a 7 year low, and with the current PE values, its quite clear its undervalued with so much potential in spite of 2017 being an year with political risks.

KenGen rights issue registered a 92% success rate, which was quite impressive. They raised about 22B. Energy is an important utility for a growing economy. Turkana’s wind power will come in line in the coming few while which will increase the electricity production.

Safaricom touched highs of 22, and with the H1 2016/17 results released early November suggested by all means, the upward trend will continue. EPS was 65% higher, thus the earning capability is intact. Some can wonder what the internal rate of return for LittleCabs is.

Africa Sovereign bonds registered impressive yields however much in due diligence need to go in hand. Mozambique Tuna Bonds was a lie and in Kenya, eyebrows were raised though the IMF said the accounting was okay; some questions are not settled. However Kenya’s debt sustainability is much in line, about 50% of GDP and economic growth is felt. This needs to go to 6% for longer time duration (say 15 years) to trickle down effectively across the country and counties.

Accountability, leadership are some requirements which are sure fundamentals for any country to steer the economy. This needs visionary, selfless leadership and being worthy of the calling.

Having failed all CTs sat in 2016, I reflected. I plan to work with an improved reading time schedule and different approach because in 2019 the IFoA will change exam format, more like the third generation upgrade.

However, I passed CT1 in April 2015.

CT3 in April 2016 had a pass mark of 60. I scored 55.

CT2/CT3 in September 2016 had a pass mark of 60 yet again. I scored 51 in both.

All in all, watch this space.

This is the last trading day of the year, 2016.

It’s been quite a rollercoaster year in the financial markets with certain themes standing out and holding significant weight.

#Brexit was a momentous occasion in the United Kingdom as they voted to “leave” the European Union. Inadvertently, the Sterling Pound fell 10% on the aftermath of the vote.

The Japanese Yen, which is a perfect carry trade currency, was surging throughout the year from 120 level to 100 level, however it snapped the trend due to a dollar rally. #TrumpRally

Long dated bonds, especially 10 year bonds in Japan and Germany registered negative yields. UK Gilts and US Treasuries also registered very low yields though they snapped the trend ultimately.

I wonder how asset managers for the pension industry are navigating the asset/ liability matching conundrum as they are overweight bonds, especially long dated bonds unlike some in general insurance who are overweight in short term dated bonds

A long political fight in the US ensued and the final result pitied Hillary Clinton against the eventual champion, Donald Trump.

In Africa, Nigeria economy fell into a recession and the situation was punctuated with capital controls on the Nigerian Naira. In as much as the Naira was allowed to float freely, from 199.00, it found resistance at 315 and many view this as still controlled and does not reflect the true market price.

South Africa’s Rand flash crash early in January during Asian trading session was an outlier where it fell about 9% in seconds. (The Pound also had a 6% flash crash during the quiet Asian trading session, marked with low volumes.)

The NSE touched a 7 year low, and with the current PE values, its quite clear its undervalued with so much potential in spite of 2017 being an year with political risks.

KenGen rights issue registered a 92% success rate, which was quite impressive. They raised about 22B. Energy is an important utility for a growing economy. Turkana’s wind power will come in line in the coming few while which will increase the electricity production.

Safaricom touched highs of 22, and with the H1 2016/17 results released early November suggested by all means, the upward trend will continue. EPS was 65% higher, thus the earning capability is intact. Some can wonder what the internal rate of return for LittleCabs is.

Africa Sovereign bonds registered impressive yields however much in due diligence need to go in hand. Mozambique Tuna Bonds was a lie and in Kenya, eyebrows were raised though the IMF said the accounting was okay; some questions are not settled. However Kenya’s debt sustainability is much in line, about 50% of GDP and economic growth is felt. This needs to go to 6% for longer time duration (say 15 years) to trickle down effectively across the country and counties.

Accountability, leadership are some requirements which are sure fundamentals for any country to steer the economy. This needs visionary, selfless leadership and being worthy of the calling.

Having failed all CTs sat in 2016, I reflected. I plan to work with an improved reading time schedule and different approach because in 2019 the IFoA will change exam format, more like the third generation upgrade.

However, I passed CT1 in April 2015.

CT3 in April 2016 had a pass mark of 60. I scored 55.

CT2/CT3 in September 2016 had a pass mark of 60 yet again. I scored 51 in both.

All in all, watch this space.

Foreign Exchange

Last trade (FOREX GBP/USD) 1.2299

Last trade (FOREX EUR/USD) 1.0567

Last trade (FOREX USD/JPY) 116.82

Last trade (FOREX AUD/USD) 0.7228

Last trade (FOREX GBP/USD) 1.2299

Last trade (FOREX EUR/USD) 1.0567

Last trade (FOREX USD/JPY) 116.82

Last trade (FOREX AUD/USD) 0.7228

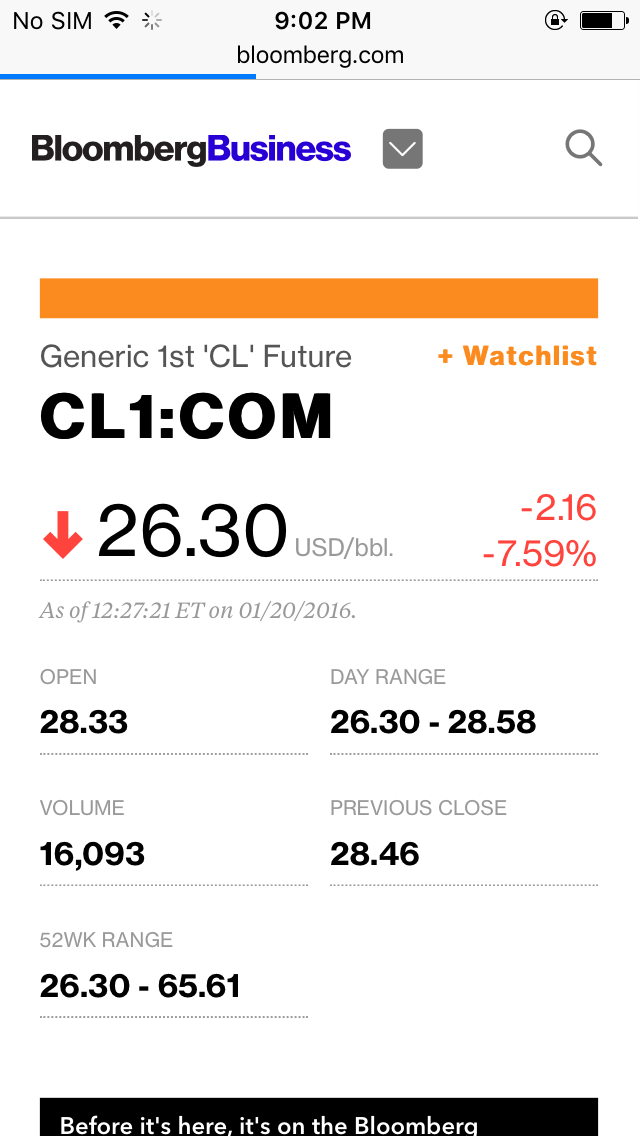

Commodities

Gold $ 1,161.5

Oil $ 54.01

Gold $ 1,161.5

Oil $ 54.01

Government Bonds Yields

US Treasuries 10 Year 2.472

German Bunds 10 Year 0.174

Japan 10 Year 0.041

UK Gilts 10 Year 1.091

US Treasuries 10 Year 2.472

German Bunds 10 Year 0.174

Japan 10 Year 0.041

UK Gilts 10 Year 1.091

Market Indices

The Dow 19,819.78

NSE All Share Index 131.30

FTSE/JSE All Share Index 50,653.54

The Dow 19,819.78

NSE All Share Index 131.30

FTSE/JSE All Share Index 50,653.54

Source for Market Data

Bonds: http://online.wsj.com/mdc/public/page/mdc_bonds.html?mod=mdc_topnav_2_3012

Commodities: http://online.wsj.com/mdc/public/page/mdc_commodities.html?mod=mdc_topnav_2_3014

NSE All Share: https://www.bloomberg.com/quote/NSEASI:IND

FTSE/ JSE All Share: https://www.bloomberg.com/quote/JALSH:IND

FX Crosses: http://online.wsj.com/mdc/public/page/mdc_currencies.html

Bonds: http://online.wsj.com/mdc/public/page/mdc_bonds.html?mod=mdc_topnav_2_3012

Commodities: http://online.wsj.com/mdc/public/page/mdc_commodities.html?mod=mdc_topnav_2_3014

NSE All Share: https://www.bloomberg.com/quote/NSEASI:IND

FTSE/ JSE All Share: https://www.bloomberg.com/quote/JALSH:IND

FX Crosses: http://online.wsj.com/mdc/public/page/mdc_currencies.html

Gold : One Year Chart

Brexit : A 10% move on cable due to Vote “Leave”

Brent Crude : One Year Chart

10 Year UK Gilts (Yield)

USD/JPY One Year Chart

10 Year US Treasuries (Yields)

Brent Crude Oil : Touching a Low in January, 2016

Best (and Worst) performing currencies Year-To-Date